Liquidity isn't invisible.

You've just never seen it this way.

Real-time market microstructure analytics, zero-allocation infrastructure monitoring, and cross-venue intelligence.

Core Capabilities

Built-in infrastructure powering every VisualHFT deployment.

Supported Connectors

Analytics & Plugins

Modular extensions for real-time market analytics, built for the speed of electronic trading.

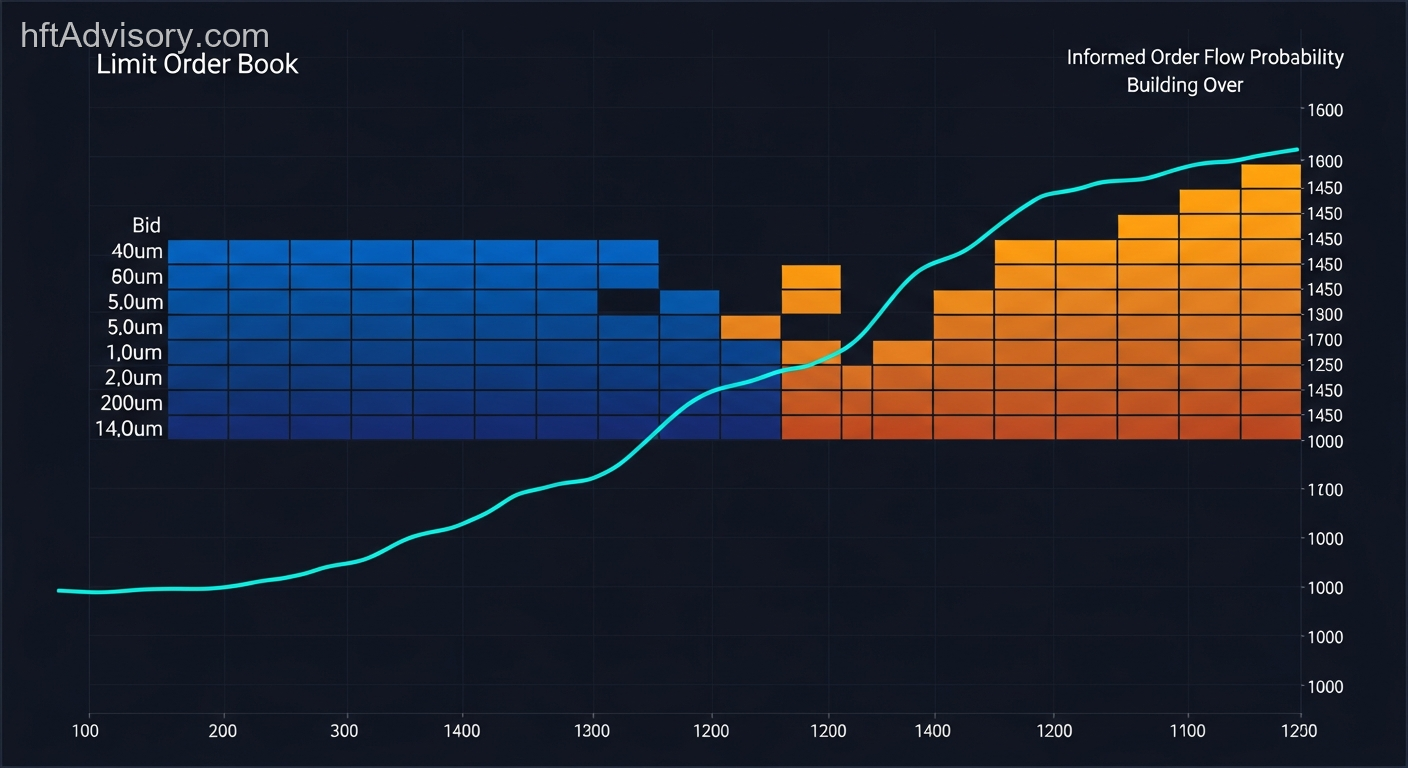

LOB Imbalance Study

Calculates Limit Order Book Imbalances

Market Ratios Study

Six critical market microstructure ratios

Trade-to-Order Ratio

Executed trades vs order book activity

Cross-Venue Analytics

Multi-venue market analysis tools

Multi-Venue Prices

Real-time mid-price chart across all venues

Arbitrage Monitoring

Identifies cross-venue price gaps

Plans & Pricing

From open-source community analytics to institutional-grade L3 data. No hidden fees, no market-data markup.

Coming Soon

We're finalizing our pricing tiers. Join the waitlist to be the first to know when plans go live.

Join the WaitlistWhere We're Headed

From beta to enterprise — our path to building the definitive market microstructure analytics platform.

Beta Launch

The platform goes live for early users

Access the core platform with real-time market microstructure analytics, direct exchange connectivity, and our first AI-powered insights.

- Real-time analytics: Volume Delta, Order Imbalance, VPIN, Latencies, Risk Metrics

- AI-assisted anomaly detection and predictive signals on order flow

- Intuitive visualizations and dashboards built for quants

- Guided onboarding and direct feedback channel with the team

Beta Expansion

Community & academia partnerships

Making the open-source project a true community effort and forging partnerships with academia for market microstructure research.

- Contributor programs, community-built plugins, and Partner Quant Program

- Academia: research data access, co-authored papers, university outreach

- Level 3 Order Book Visualization and advanced execution metrics

- SDKs and developer tools for custom integrations

- Smarter AI: pattern recognition and explainable anomaly detection

Public Launch

Tiered access for everyone

VisualHFT goes public with free access for individuals and premium plans for professional and institutional users.

- Tiered pricing: free for individuals, premium for advanced tools

- Equities market integration with leading global exchanges

- Heatmaps, statistical overlays, real-time market depth

- Academic research and insights available to the community

Enterprise & New Markets

Institutional-grade scale

Enterprise-grade capabilities, new asset classes, and deep exchange partnerships.

- Scalability, dedicated support, and compliance tooling

- AI-driven predictive analytics and surveillance intelligence

- Transaction Cost Analysis (TCA) for execution optimization

- Derivatives, fixed income, and broader asset classes

- Deeper exchange and data vendor partnerships

Want to shape the roadmap? Join our beta and give direct feedback.

Get Early AccessTechnology Stack

A hybrid ecosystem combining a robust open-source core with powerful commercial extensions.

High-Performance Core

The heart of the platform, engineered for speed and efficiency.

- C# .NET 8 Optimization

- Zero-allocation memory model

- Lock-free concurrent queues

Data Engine

Robust data handling for high-frequency market events.

- Time-series optimized storage

- Nanosecond precision timestamps

- Efficient binary compression

Visualization Engine

optimized rendering system for high-density data.

- WPF / Software Rendering

- Responsive Grid Layout

- Multi-monitor support

GPU Acceleration

Hardware-accelerated rendering for extreme data loads.

- DirectX 11/12 Engine

- 144+ FPS Rendering

- Hardware Instancing

L3 Data Core

Coming SoonArchitecture designed for full order book reconstruction.

- Market-By-Order (MBO) support

- Individual Order Tracking

- High-throughput event processing

Privacy & Security

Client-side architecture ensuring data sovereignty.

- Local API Key Storage

- Encrypted Configuration

- No Cloud Dependency

Latest Insights

Engineering deep dives, product updates, and trading research.

VPIN and Real-Time Order Toxicity: What Your Execution Stack Cannot See Before the Fill

Read article →

Getting Started with VisualHFT: Real-Time Market Microstructure Analysis in 10 Minutes

Read article →

Trade Surveillance in Modern Financial Markets

Read article →

Volume-Synchronized Probability of Informed Trading (VPIN)

Read article →Join the Community

Collaborate with traders, developers, and quants building the future of algorithmic trading.

Forums & Support

Discussion boards for Q&A, strategy sharing, and community support.

Contributor Program

Join our partner program. Contribute code or research and earn rewards.